Trusted By:

We Serve 6 - 8 Figure Entrepreneurs

In The LowCap & MidCap Market Best

Our clients fit one of the following boxes

Scalable business Models

Internet | Software | multi store

We praise ourselves to rapidly unlock revenue in scalable by optimizing business models, cutting costs, bringing cashflowing partnerships

xx

Annual Revenue:

$500.000 - $5.000.000

We support profitable companies at the buy and sell side from preparation to exit or acquisition by maximizing company value or advanced dealmaking strategies to drive 7x return on capital.

Annual Ebitda

$200.000 - $2.000.000

With over 300+ clients, US$240 million dollar in transactions we fasttrack entrepreneurs to access capital from our network of 15.000 investors.

Aren't you checking our criteria, check our free resources to get instant support

9Programs

300+Happy Clients

$240M+Transactions

Optionally Co-Invest in Deal With SevenX Syndicate

Co-Invest In Deals Together or Bring Yours To The Dealroom For Investment

No obligation, simply optional! On a monthly base the SevenX team brings prospective deals to the table with the purpose to acquire ventures or make majority investments

Scalable b2b business models

Internet | Software | Multi Store | Manufacturing

Investments starting at $2.500 per member

SPV structures

SevenX Funding

Our Clients Close Their Equity & Debt Deals under 60 Days

With over 300+ clients, US$240 million dollar in transactions and access to an network of 15.000 investors we fast track capital requirements from successful entrepreneurs.

Our global team of vc's in residence, venture analysts, fractional CFOS, designers & copy writers manages to get you ready to raise under 14 days.

SevenX Exits

Effortless Sell Your Business Under 4 Months At a 20% Premium Easy.

We support profitable companies at the buy and sell side from preparation to EXIT, maximizing enterprise value in the process through advanced growth strategies and dealmaking tactics to drive 7x return on capital.

SevenX Inspiration Letters

Receive Funding, M&A & Growth Strategies Weekly

Still Getting Ghosted by Investors? Here’s How to Flip the Script

Why Investors Keep Ignoring Your Pitch (And How to Fix It)

You’ve built something great.

You’ve crafted the perfect pitch.

You’re reaching out to investors, following up, and doing everything you can to close a deal.

Are You Making This Mistake?

Yet… silence.

Investors ignore your emails, don’t reply to follow-ups, and seem interested—but never commit. Sound familiar?

If you’re stuck in this frustrating cycle, it’s not because your business isn’t investable. It’s because your fundraising strategy is working against you.

💡 The Truth About Investor Ghosting

Most founders think that raising capital is all about hustling harder, pitching more investors, and following up relentlessly.

But that’s the fastest way to push investors away.

The reality? Investors don’t want to be sold. They want to discover great deals.

When you position yourself as a founder who is chasing investors, you create the impression that:

❌ Your deal isn’t competitive

❌ You’re desperate for funding

❌ There’s no urgency for them to act

And when an investor doesn’t feel a sense of urgency or exclusivity, they don’t act.

So, what’s the fix?

Flip the Script: Make Investors Chase YOU

Instead of pushing your deal onto investors, you need to orchestrate your fundraising like a master conductor.

This means:

✅ Building an investor pipeline – Have multiple investors in your funnel so YOU hold the leverage.

✅ Creating FOMO – When investors see others interested, they’ll move faster.

✅ Positioning your deal as exclusive – Make it seem like funding is limited, and they need to act now.

✅ Acting like you don’t need the money – The less you seem desperate, the more they want in.

This is how top founders attract and close serious investors—without spending months chasing leads who were never serious in the first place.

Want to Access the Full Fundraising Playbook?

If you’re tired of being ghosted and want to attract investors who are excited to fund your business, I’ve got something for you.

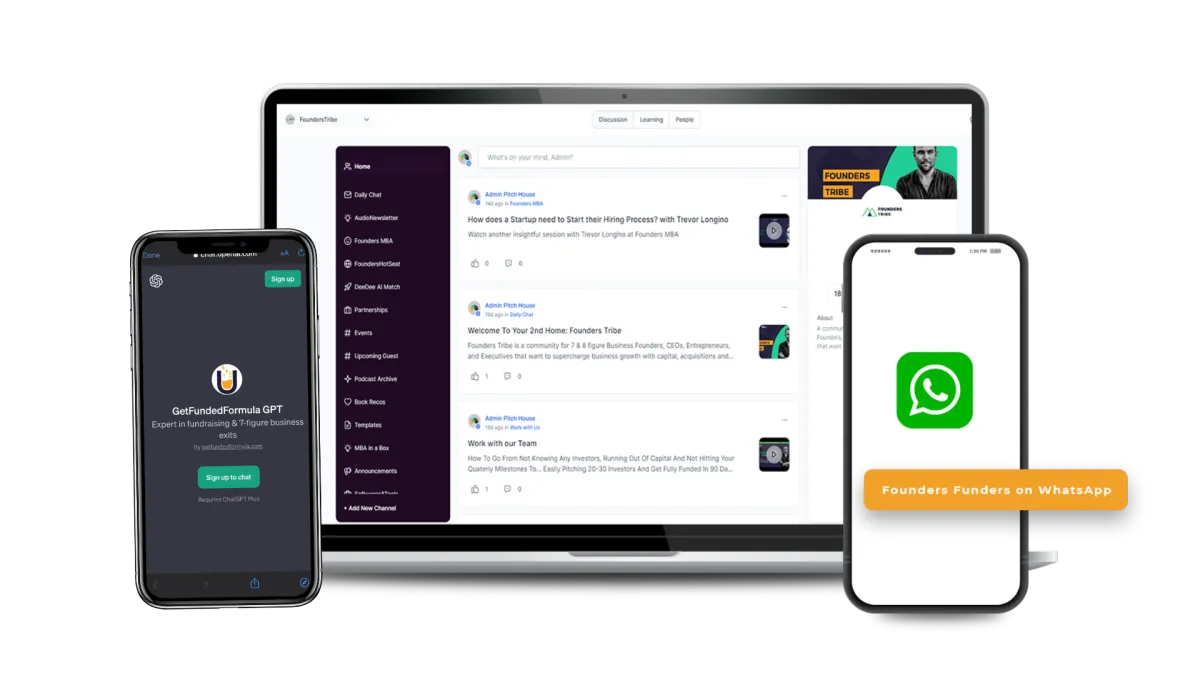

Inside the SevenX Dealroom Community, we break down proven capital-raising strategies that help founders close deals faster, without wasting time on cold leads.

Stay Tuned

PS, I created a short video breaking down this concept...Check it out here!

👉 Name: Hi, my name is Sven Milder, founder of SevenX Group, a low-cap boutique investment bank that supports business builders with building, funding, buying, and selling companies.

👉 Same: Best to be compared as an interface between Acquire.com and Tiny Capital.

👉 Fame: To date, we have supported 300+ business builders with US$240M in transactions.

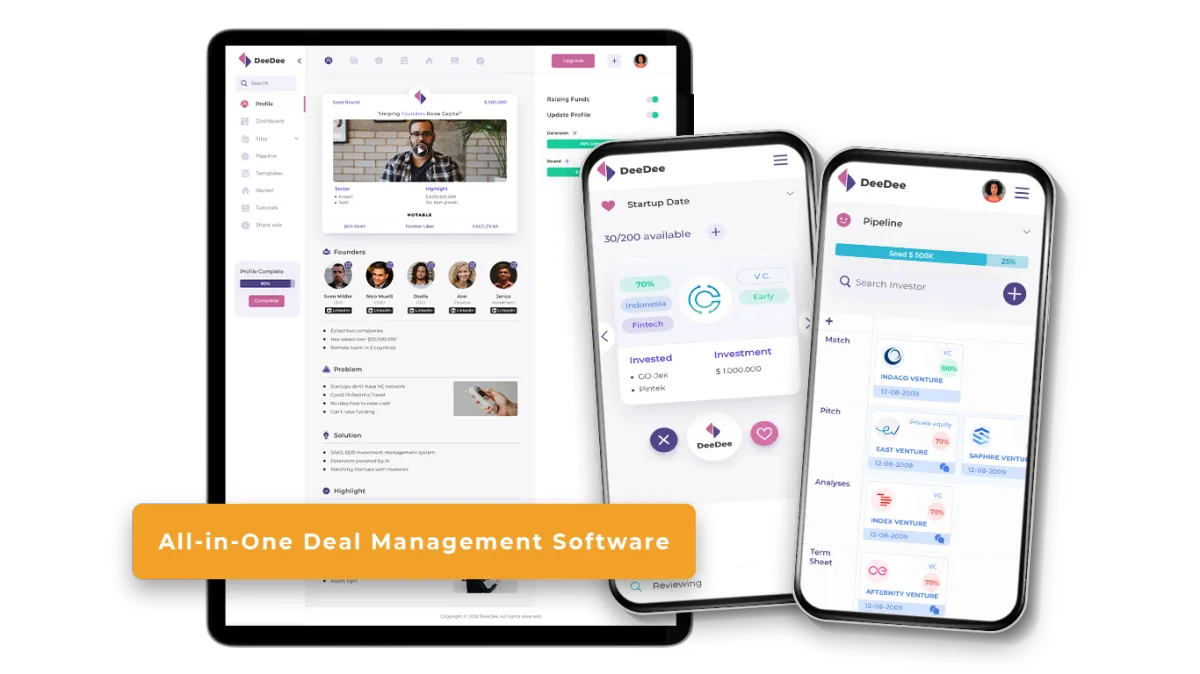

👉 Aim: We currently focus on launching Deedee, a digital investor relations platform to connect investors with founders, accelerating deal flow and deal closure.

👉 Game: Our target is to build a holding company of cash-flowing, scalable businesses offering fractional ownership through SPVs to our network of investors.

Let your weekends count!

Raise your Skills & Expertise

Discover Our Top-Rated Programs that you can start today

Present Your Deal to 15.000 Investors & Close deals faster

After supporting over 300+ clients and managing over US$240.000.000 in transactions we build the only platform an entrepreneur ever needs to grow, fund, acquire and exit a business.

Listen & Learn From The Experts

At the SevenX Pod we are pulling the curtain and interview weekly the experts that fast track wealth generation through business & acquisitions.

Ep 11: Build Startups That Beat The Test Of Time

Yinglan Tan is the CEO and Founding Managing Partner at Insignia Ventures Partners. He sourced multiple investment opportunities for Sequoia India and has written several books. His latest work, Navigating ASEANnovation. He also hosts a podcast called "On Call with Insignia Ventures" where he dial in calls with the region's innovators and investors.

Ep 10: Be Patient. Product Market Fit Will Set You Up For Scale

Giacomo has been working in the internet industry in Southeast Asia building startups in several countries in Asia. In 2019, he launched Lifepal, an online marketplace for health and life insurances to help customers in choosing and using the right policy fit for their needs.

Ep 9: Managing Your Pivot Like a Pro

Viktor Kyosev decided to do a full 180-degree turn and move to a more dynamic field – entrepreneurship. Ever since he has built from the ground up – start-ups ranging from event planning to education, social entrepreneurship, photography, hospitality, and real estate.

Find Accountability & Inspiration To Achieve Your Biggest Dreams

at SevenX Club & Letters

What results do you dare to imagine when you combine information and implementation with commitment and drive? You'll access new levels of business growth.

Our club is all about business growth through capital, acquisitions and proven growth levers

What our Clients are Saying

Here are a few clients' cases in a variety of industries

"I got many insights especially about startup fundraising and investors that I haven't heard before."

Wilson, CEO

“If you want to get your investors to notice you, you have to make your business scalable and attractive ... GET ON TO THIS program!"

Shasha, Managing Director

“The best part of this program is that it addresses the emotional and intimate side of business relationships that you don't get out of a typical business school.”

Mark, Marketing Manager

Frequently Asked Questions

What programs do you offer to support me?

We support 7 & 8 figure entrepreneurs running scalable business models with their capital requirements, exit planning and acquisitions through a variety of engagements. From self paced programs to skill up to cohort based programs where you work with other entrepreneurs side by side to one-on-one engagements for demanding entrepreneurs.

Our self paced program start at US$150,-.

Can you help me to raise Capital for my business?

We have supported over 300+ clients with over US$240.000.000 in capital and M&A transactions. With a network of over 15.000 angels, high net worth individuals, family offices, venture capitalist we are confident that we can service you with the right investor. To discover if you qualify for our support, please run our ready to raise test.

Do you work on success fee based?

The short answer is no. The better answer is. We decide this on a case by case basis. For example. When you are a seed stage startup without profitability its impossible to guarantee funding. When you are profitable multi store health clinic that wants to expand, we can consider.

That being said in most of our one-on-one engagements we work with a competitive program fee + a success fee backed by our 5X GetFunded guarantee that every engagement we accept we guarantee a 5X in funding commitment in line with the fee you pay us. So in that case there are always winner.

I'd like to discuss a partnership?

We love partnerships. Mostly because its a win-win for all parties. please send your request to [email protected]

What is SevenX Capital?

SevenX Capital is our investment arm that acquires minority, majority or full ownership stakes in cashflowing business, profitable internet software and multi store businesses. We pride ourselves for a fast track acquisition process that can be concluded within 60 days and is mostly a combination of a cash and differed payments component.