Read about:

Still Getting Ghosted by Investors? Here’s How to Flip the Script

Why Investors Keep Ignoring Your Pitch (And How to Fix It)

You’ve built something great.

You’ve crafted the perfect pitch.

You’re reaching out to investors, following up, and doing everything you can to close a deal.

Are You Making This Mistake?

Yet… silence.

Investors ignore your emails, don’t reply to follow-ups, and seem interested—but never commit. Sound familiar?

If you’re stuck in this frustrating cycle, it’s not because your business isn’t investable. It’s because your fundraising strategy is working against you.

💡 The Truth About Investor Ghosting

Most founders think that raising capital is all about hustling harder, pitching more investors, and following up relentlessly.

But that’s the fastest way to push investors away.

The reality? Investors don’t want to be sold. They want to discover great deals.

When you position yourself as a founder who is chasing investors, you create the impression that:

❌ Your deal isn’t competitive

❌ You’re desperate for funding

❌ There’s no urgency for them to act

And when an investor doesn’t feel a sense of urgency or exclusivity, they don’t act.

So, what’s the fix?

Flip the Script: Make Investors Chase YOU

Instead of pushing your deal onto investors, you need to orchestrate your fundraising like a master conductor.

This means:

✅ Building an investor pipeline – Have multiple investors in your funnel so YOU hold the leverage.

✅ Creating FOMO – When investors see others interested, they’ll move faster.

✅ Positioning your deal as exclusive – Make it seem like funding is limited, and they need to act now.

✅ Acting like you don’t need the money – The less you seem desperate, the more they want in.

This is how top founders attract and close serious investors—without spending months chasing leads who were never serious in the first place.

Want to Access the Full Fundraising Playbook?

If you’re tired of being ghosted and want to attract investors who are excited to fund your business, I’ve got something for you.

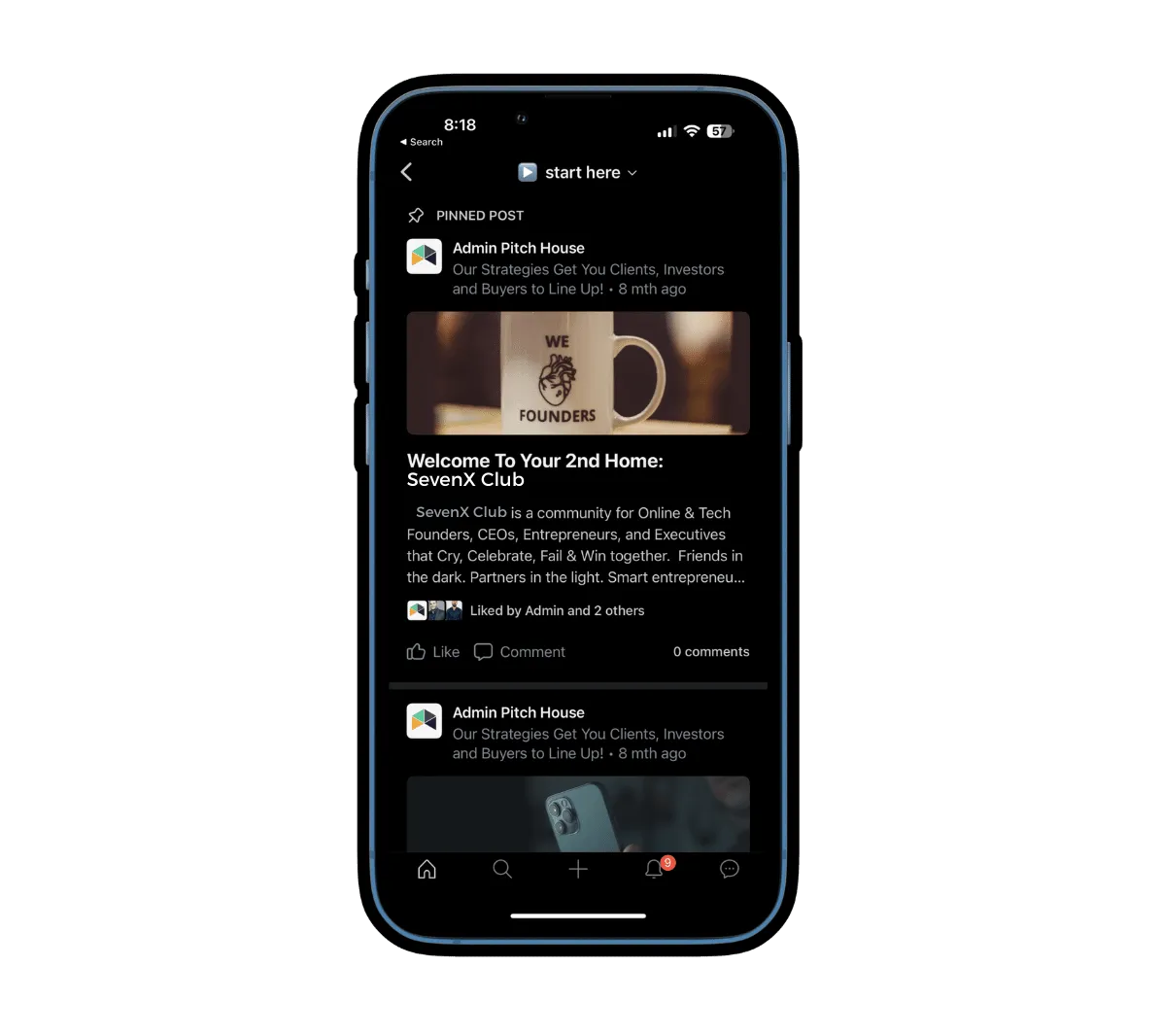

Inside the SevenX Dealroom Community, we break down proven capital-raising strategies that help founders close deals faster, without wasting time on cold leads.

Stay Tuned

PS, I created a short video breaking down this concept...Check it out here!

👉 Name: Hi, my name is Sven Milder, founder of SevenX Group, a low-cap boutique investment bank that supports business builders with building, funding, buying, and selling companies.

👉 Same: Best to be compared as an interface between Acquire.com and Tiny Capital.

👉 Fame: To date, we have supported 300+ business builders with US$240M in transactions.

👉 Aim: We currently focus on launching Deedee, a digital investor relations platform to connect investors with founders, accelerating deal flow and deal closure.

👉 Game: Our target is to build a holding company of cash-flowing, scalable businesses offering fractional ownership through SPVs to our network of investors.