Read about:

Not All Money is Good Money: How to Choose the Right Investor for Your Business

Not All Money is Good Money: How to Choose the Right Investor for Your Business

Taking the wrong investor can silently destroy your business, drain your resources, and leave you trapped in a bad deal.

Many founders make the mistake of thinking that securing funding is the finish line. But in reality, who you take money from matters just as much as how much you raise.

Are You Making This Mistake?

It’s easy to get excited when an investor offers capital. But if money is all they bring, you’re missing out on massive value.

The right investor does more than write a check—they accelerate your business growth in ways that money alone never will.

How to 3X Your Investment Value by Choosing the Right Investor

When evaluating investors, look beyond the dollar amount and consider these four critical factors:

✅ Capital – The Starting Point, Not the Goal

Yes, money is necessary. But funding without strategy is just fuel with no engine.

If your investor doesn’t understand your vision or growth plan, that money won’t take you far. Always ask: “Is this investor aligned with my long-term success?”

✅ Connections – The Hidden Growth Lever

The right investor opens doors to partnerships, talent, and new business opportunities.

A well-connected investor can introduce you to key industry players, potential customers, and future funding sources. Before signing a deal, find out: “Who can they connect me with?”

✅ Competence – The Mentor Effect

An experienced investor saves you from costly mistakes by offering strategic advice and industry insights.

They've seen businesses like yours succeed (and fail) before. Leverage their expertise to avoid pitfalls and scale faster. Ask yourself: “Can I learn from this investor?”

✅ Credibility – The Magnet for Future Funding

A reputable investor signals confidence to the market, attracting better deals, bigger clients, and more investors.

Your first investor can impact your ability to raise future rounds. Always consider: “Will this investor strengthen my company’s reputation?”

Are You Accepting “Dumb Money” or Securing “Smart Money”?

Not all investment is created equal. Some investors drain your time, slow down decision-making, and create friction instead of growth.

The difference between smart and dumb money isn’t just experience—it’s alignment, strategy, and impact.

If You Want To Build the Right Network

Surrounding yourself with the right investors, partners, and dealmakers can be the difference between a struggling startup and a thriving business.

The right connections don’t just bring capital—they bring opportunities, insights, and momentum.

Want to Be Part of the Right Conversations?

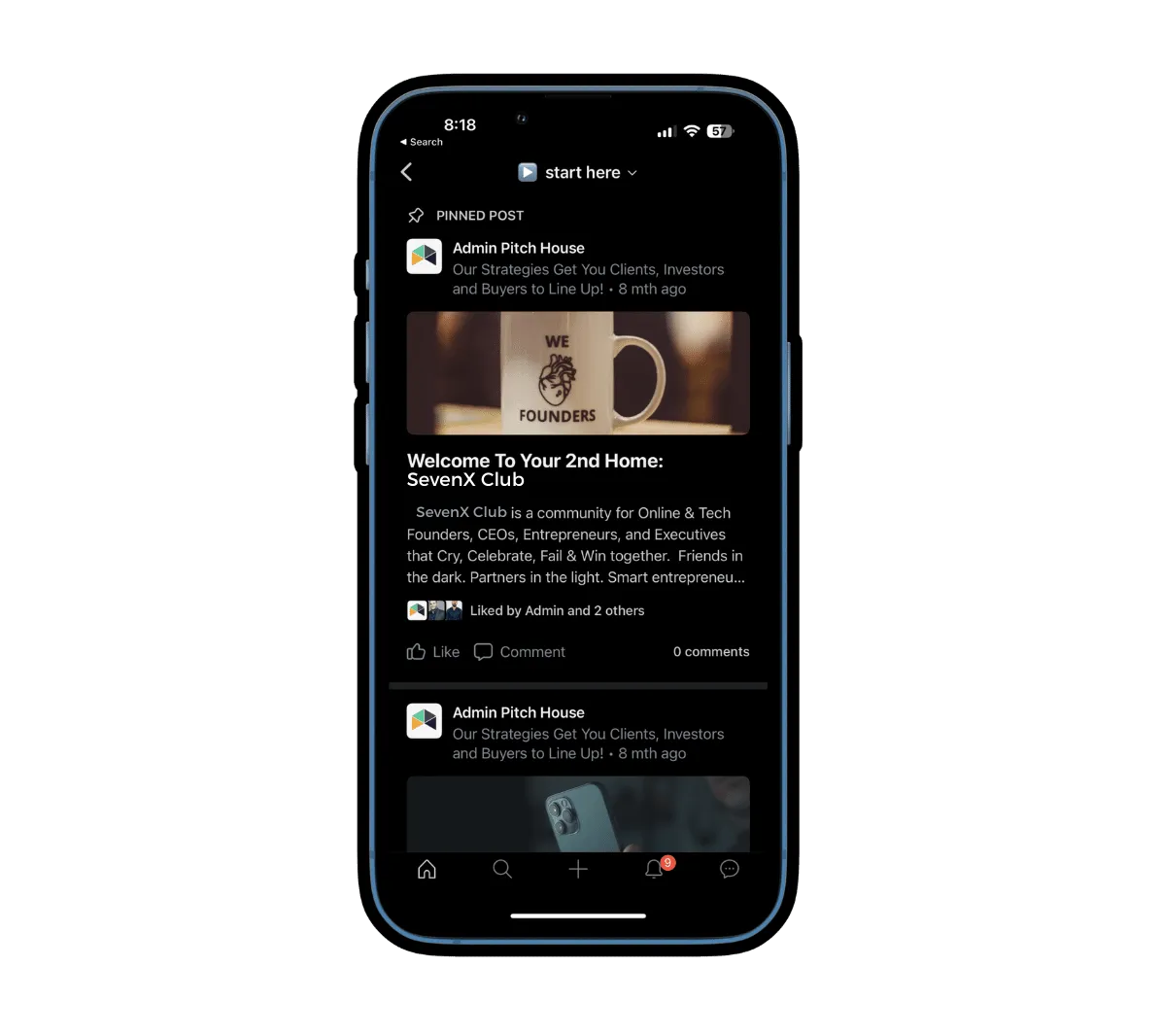

The SevenX DealRoom is where real dealmakers and business leaders exchange insights, strategies, and opportunities to grow through funding and M&A. It’s a space built for those who understand that the right partnerships make all the difference.

Stay Tuned

PS, I created a short video breaking down this concept...Check it out here!

👉 Name: Hi, my name is Sven Milder, founder of SevenX Group, a low-cap boutique investment bank that supports business builders with building, funding, buying, and selling companies.

👉 Same: Best to be compared as an interface between Acquire.com and Tiny Capital.

👉 Fame: To date, we have supported 300+ business builders with US$240M in transactions.

👉 Aim: We currently focus on launching Deedee, a digital investor relations platform to connect investors with founders, accelerating deal flow and deal closure.

👉 Game: Our target is to build a holding company of cash-flowing, scalable businesses offering fractional ownership through SPVs to our network of investors.